Unlike some credit cards, the Blaze Credit Card does not charge application fees, account setup fees, monthly maintenance fees, or other hidden costs. In addition to late or refund fees, there are fees for adding an authorized user or receiving a cash advance. You can read the Blaze Credit Card Reviews before applying for the same. However, credit cards charge these fees by default regardless of your credit score, irrespective of your refund score.

Or

Bad or fair credit can make it challenging to obtain a loan, rent an apartment, or even find employment. You can recover from a low credit score using intelligent tools like credit cards. The first step is identifying the problem and deciding if you want to repair your credit. To improve your credit score and financial situation, you can take action.

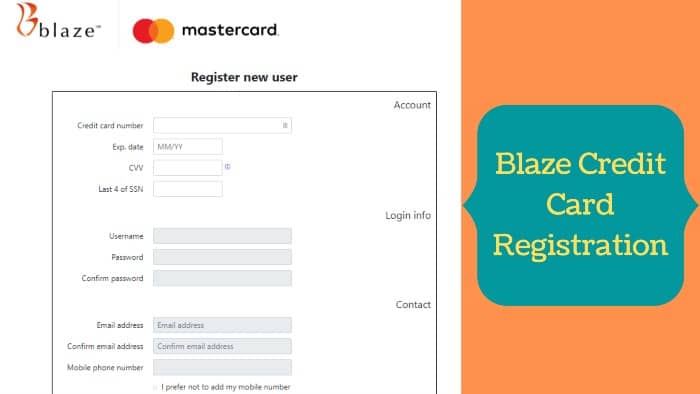

Guide To Register At www.blazecc.com

Many people have the habit of reading Blaze Credit Card Reviews while registering for the same. Here are the steps to register for the Blaze credit card:

- Visit the official Blaze Credit Card registration page (www.blazecc.com).

- Clicking above will open the login window.

- Just click “Register New User” on this form.

- Clicking on it will open another menu, “Register New User.”

- Enter your account number, expiration date in months and years, the last three digits on the back of the card, which is the card’s security code, and the last four digits of your SSN

- Finally, click “Next.”

- It verifies your credentials and, if approved, sends your account registration details such as username and password to your registered email address.

All information you provide to the online portal must be accurate, valid, and current to confirm successful registration. By submitting your registration and login information, you authorize the credit card agency to review and verify all data entered into the system.

Activate Your Blaze Credit Card By Phone

If you would like to activate your Blaze credit card over the phone, please call 1-605-782-3472. A staff member will help you activate your card. You must follow their instructions when activating your card.

How To Apply For Blaze Card?

It’s easy to fill out a Blaze Card application online. Many people read Blaze MasterCard reviews before applying for this card. Follow the steps below:

- To get started, visit www.blazecc.com.

- Then click the orange link that says Apply Now.

- On the next page, scroll to the bottom of the page. Click the yellow “Apply Now” button.

- Please type your first and last name, social security number, date of birth, and email address.

- Include your address, phone number, and mother’s maiden name.

- Write down your annual income. Indicate whether you are a tenant or owner and indicate your monthly rent or mortgage.

- Click “Application Overview” and follow the instructions to complete your application.

Steps To Follow For Blaze Credit Card Login

To access the Blaze Credit Card login page, follow these steps:

Step 1: Open a new tab in the web browser. Before using your web browser for banking purposes, you should update it.

Step 2: Next, select the web address “www.blazecc.com” from the clipboard and paste it into the address bar and type it.

Step 3: Locate and click on the “Account Login” tab highlighted in green.

Step 4: Paste your username and password into the appropriate fields.

Step 5: Click the “Connect” button below the box.

Requirements For Blaze MasterCard Login

Enrolling in the Blaze MasterCard requires the following:

- Any browser will do, including Google Chrome, Mozilla Firefox, Opera, Apple Safari, or Microsoft Internet Explorer.

- It would be best to have your Blaze Credit Card Login username and password handy.

- Go to the official Blaze Credit Card login website (www.blazecc.com).

- Here are the devices that you can use for Blaze MasterCard Login:

- Smartphones

- Tablets

- IPad

- Personal computer

- Laptops

- A good internet connection is required in your area to register with the Blaze credit card.

- If you are signing up on your smartphone, tablet, or iPad, you must install the Blaze Mastercard Mobile App on your device.

Troubleshooting Guide For Logging Into Blaze Credit Card Login Portal

If you are unable to access the BlazeCC login portal, follow these steps:

- Make sure you have a good internet connection before using this service.

- It would be helpful if you did not use your passwords in front of others because people look over your shoulder and steal your credentials.

- The key that activates the caps lock on the keyboard must remain off.

- Try clearing your browser’s cache and cookies if the above steps don’t work.

- If you have a virtual private network, please disable it before proceeding.

- If you forget your BlazeCC login password, you will need to recover it yourself. You are responsible for changing your password or username to log in to BlazeCC.

Retrieve Your Blaze MasterCard Login Credentials

The steps to recover your Blaze board login username and password are as follows:

- Go to the official Blaze Credit Card website.

- Scroll down to the search section and click on the “Account Login” tab highlighted in green.

- Click the Forgot username or password? Link placed in the “Login” tab.

- Click the “Next” button again to start the process.

- Carefully add all the information requested on the page.

- Click the Next button”.

- After verification by the server, you will receive a link to retrieve your login credentials.

- Choose the desired option and complete the rest of the process.

Blaze Credit Card Bill Payment Options

There are several Blaze Credit Card payment methods that you can use to pay your credit card bills:

Online BlazeCC Payment Through Login

- Visit the official BlazeCC login page to pay your credit card bills online.

- Enter your username and password

- Click Connect

- Click the Make Payments button and select the card you want to use to make the payment.

Payment By Mail

You can send a cheque to,

Blaze MasterCard,

P.O. Box 2534,

Omaha, NE 68103-2534.

You must provide payment information on the back of the check, such as your account number.

Payment By Making A Phone Call

For phone payments, call 866-205-8311. Customer service representatives at this number will explain how to pay your credit card bills.

Benefits Of Blaze Credit Financing

Easy Approval

Even if your credit score is low, you can still qualify for the Blaze Credit Card if you have a steady job. Examiners wrote several assessments of Blaze cardholders, which were approved soon after the bankruptcy settlement.

It Is A Tool That Builds Credit

This company reports to major credit bureaus. Making monthly purchases with the card and then making payments on time will help improve your credit score. It will help you qualify for better credit cards with no annual fee and lower APRs on amounts owed.

There Are No Hidden Fees

Some faulty or safe credit cards charge astronomical fees just to become a cardholder. It seems clear from the start that there is an annual fee of $75, and that fee is charged to your account immediately upon approval. Upon receiving your card, you will receive an APR statement, which in most cases is 29%, but some have the option to select a lower APR.

Features Of Blaze Credit Card

Blaze credit card features are as follows:

- APR: There is a fixed APR of 29.9% for all cardholders.

- Annual Fee: All cardholders pay a yearly fee of $75. Some cardholders have left comments online that they were successful in getting First Savings Bank to waive the annual fee after a few years of payment at the time.

- Credit Limit: Most people start with a credit limit of $350, but those with the highest credit scores report as high as $1,500.

- Credit Limit Increase: Users who pay their bills on time and maintain a current account can request an increase in their credit limit after six months.

- Secured vs. Unsecured: It is an unsecured credit card, so you don’t need to pay a deposit.

- Customer Service: Customer service is located in the U.S. and appears to be excellent.

Blaze Mastercard Mobile Application

Nowadays, everyone has smartphones in their hands. You can do your financial transactions at home instead of going to financial institutions to get money. You can find Blaze MasterCard reviews regarding its app on Google Play and Apple Stores.

We are talking about the mobile app for the Blaze credit card by Erste Sparkasse. First Savings Bank has launched the mobile app for Blaze balance holders, known as the Blaze Mastercard mobile app. It is free for all smartphone users in Android or Apple versions. Here are some of its features:

- View or download your monthly statement and check your balance and credit limit.

- Cardholders can make their payments by viewing the due date and online payments.

- Managing automatic payment is as easy as logging in, editing, or canceling.

- You can update your account information (address and phone number) by opening your app with your credentials.

Customer Service Centre

The First Savings Bank Blaze Credit Card opens the customer service desk to hire candidates with good communication, persuasion, and problem-solving skills. Hired by Blaze Credit’s Contact Center, these candidates will mentor Blaze’s credit card customers. The aim is to show customers who hold a Blaze credit card issued by First Savings Bank.

Blaze’s Customer Service Center team will help customers with their issues and questions. Customers can call the Blaze Credit Card Customer Service Center from 7 am to 9:00 pm CST. For questions regarding the Blaze Credit Card, please contact the Blaze Credit Card Phone Number: 1-866-205-8311. You can call this number between 7 am and 9 pm.

You can call Blaze’s Credit Card Customer Service number, which will be happy to help you with any issues with your credit card. The Blaze Credit Card Customer Service Center mailing address is:

P.O. Box 5096,

Sioux Falls SD 57117-5096

| Official Site | Blaze Credit Card |

|---|---|

| Country | United States Of America |

| Mobile Application Available | Yes |

| Registration Required | Yes |

| Managed By | First Savings Bank |

About First Savings Bank

At First Savings Bank, we promise to meet our customers’ banking needs. Since we started our operations in Beresford, South Dakota, in 1913, we’ve taken pride in treating each customer with respect and care. The South Dakota First Savings Bank Blaze credit card offers a trusted way to improve credibility through timely payments and responsible management.

First Savings Bank’s mission is to support the financial goals of individuals and businesses in the communities we call home. The Blaze Credit Card is an unsecured credit card from First Savings Bank. The card offers a fixed APR on purchases and cash advances, reasonable lines of credit (with the possibility of increases), and an annual fee of $75.

Frequently Asked Questions

How To Get The Blaze Credit Card Customer Service Number?

To access the customer service phone, follow this guide;

- Visit https://blazecc.com/

- Click on the Create Account button

- On the login page, tap the Contact Us button at the bottom

- Copy the number on the contact page

- Go ahead and call

Here are the steps to contact Blaze CC customer service representatives by phone.

What Is Mastercard Securecode?

MasterCard SecureCode is a service provided by MasterCard and your card issuer that offers additional security when shopping online, providing extra protection against unauthorized use of your card on file.

Who Is The Best Client For The Blaze Credit Card?

The Blaze Credit Card is ideal for people with bad credit. It gives people with low credit scores another chance to get a credit card while working on their credit.

Conclusion

First Savings Bank offers people the Blaze Card to improve their credit score. It is aimed directly at specific consumers, for example, those with low credit quality and generally higher risk. Before ordering the same, people listen to Blaze credit card reviews from online sources and current or former Blaze card holders.

This page explains the Blaze Credit MasterCard registration, the application process and how to log in and reset your credentials on the website (blazecc.com), the benefits and features, and the mobile app for using the map on your smartphones. Tablets, iPads, and customer service centers to answer your questions and complaints about your Blaze Card. I hope this page helps you if you want this kind of map.